COVID-19 has changed many things for a lot of people. Small businesses haven’t been spared either. The enactment of the CARES Act (Coronavirus Aid, Relief, and Economic Security Act) seeks to support individuals and businesses that have been hard-hit by the pandemic.

What you may not be aware of, however, are the revisions made to certain provisions of the US Bankruptcy Code. This is to offer better, reliable, and more effective bankruptcy relief to individuals and small businesses during these critical times.

This article explores everything you need to know about small business bankruptcies and what the new revisions mean for your small business.

What Is Business Bankruptcy

Filing business bankruptcy is a federal court process that a company goes through designed to help it either eliminate the debt or repay it with the oversight of the court. This can be done in one of two ways – liquidation or reorganization.

Types of Business Bankruptcies

The various types of bankruptcies that exist are classified based on the “Chapters” of the US Bankruptcy Code in which they appear.

Chapter 7: Liquidation Bankruptcy

This is perhaps the most commonly filed bankruptcy type of the three. Also referred to as “straight,” “ordinary,” or “Chapter 7” bankruptcy, it is typically used when a business’ debts are so overwhelming that restructuring or reorganization just aren’t feasible options. It is the best and sometimes the only choice for corporations, partnerships, or sole proprietorships that have no viable future or no substantial assets.

You might ask: How does business bankruptcy work in Chapter 7 liquidation? Usually, the court will appoint a trustee who then takes possession of all the business’ assets and distributes them among all the creditors.

Once the process is complete and the trustee receives their payment, the court issues a discharge indicating that the business owner has effectively been released from any debt obligation going forward.

Chapter 11: Business Reorganization

In this type, a company that’s elbow-deep in debt but with a realistic chance of turning things around reorganizes and continues with its business operations under a court-appointed trustee. It is typically used for corporations and partnerships as well as for sole-proprietorships whose income levels exceed the thresholds that would otherwise qualify them for Chapter 13 bankruptcy.

The court requires the company to file a detailed plan of reorganization that outlines how it intends to deal with its creditors. Some of the likely scenarios it can adopt include returning to profitability by repaying a portion of the debt and discharging others, debt recovery, and/or lease/contract terminations.

This plan is then presented to the creditor committee, who then votes on it. The court will only approve of the plan if it finds it to be fair and equitable to all parties. This process is lengthy and can often take more than a year to confirm.

Chapter 13: Wage Earner’s Bankruptcy

Chapter 13 is a reorganization bankruptcy that’s reserved for individuals and sole proprietorships since the two entities are indistinguishable. The ultimate goal, in this case, is the reorganization of the debt and not liquidation, as would be the case with Chapter 7.

That way, an individual gets to keep their property and is allowed to repay a portion of their debt each month over a three to five year period. The repayment amount is calculated based on income, total debt, and personal assets.

The Small Business Reorganization Act of 2019

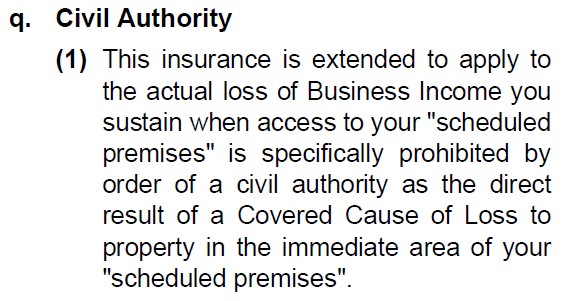

As mentioned at the beginning of this article, the CARES Act includes certain amendments to the Small Business Reorganization Act (SBRA). The whole idea behind the changes was to temporarily increase the threshold required to file for relief under the revised Chapter 11 Subchapter V of the Bankruptcy Code.

In the new dispensation, the threshold has now been increased from the previous $2,725,625 of debt to $7.5 million for one year. So, what does Subchapter V mean for your business?

- Debtors – businesses or individuals – can now file for relief if their total debt amounts to a maximum of $7.5 million, with at least 50% of it being commercial debt.

- The process of filing bankruptcy when you own a business will be a lot quicker. The deadline has been revised to 90 days as opposed to 120 days, as was previously the case.

- SBRA debtors are not mandated to pay the obligatory quarterly US Trustee’s Fees, which can be quite hefty in traditional cases.

- Debtors will be able to stretch out the duration of administrative expense claims over the entire term of the plan.

- A plan of reorganization can only be filed by the debtor, effectively eliminating the risk of creditors filing competing plans.

- Unless the court states otherwise, debtors do not have to provide a disclosure statement.

- As was previously the case in Chapter 11 Bankruptcy, creditor committees will now not be appointed under the new SBRA standards.

- A business owner can still keep their equity interest in the company even though unsecured creditors won’t receive full payment.

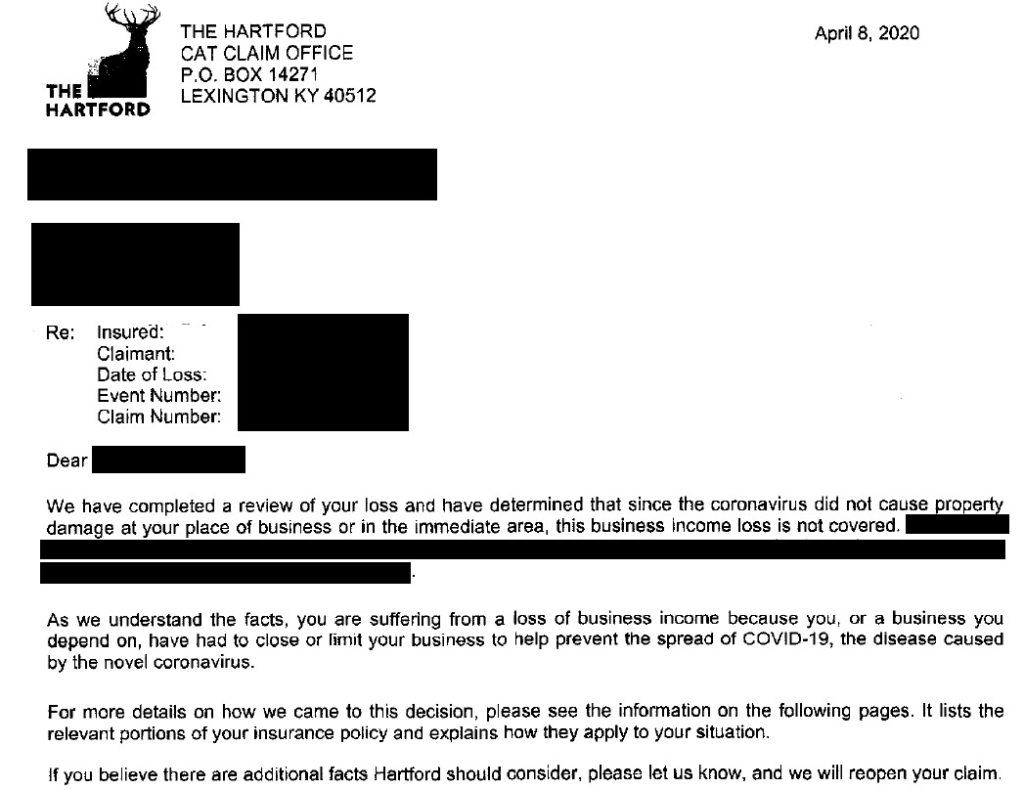

Preferential or Fraudulent Transfer

Keep in mind that a troubled company that seeks to make a fraudulent transfer of assets to hide them from the trustee, or a preferential transfer to pay off certain creditors prior to filing, does so at the expense of other creditors who are owed money in equal measure.

In such circumstances, the court-appointed trustee has the right to retrieve that property and include it in the debtor’s estate. This process is called a bankruptcy clawback and is applicable for all transfers made in the 90-day pre-bankruptcy filing window.

On the other hand, if you’re a creditor potentially facing a lawsuit that seeks recovery from a trustee despite having fully performed under the terms of a contract, you may need to seek the services of a business bankruptcy attorney to defend against it.

Save Time and Money With the New SBRA

The main benefit of the new SBRA standards is that small businesses with debts amounting to less than $7,500,000 can reduce the punitive time and expense costs associated with the bankruptcy process.

That way, companies that file get to reap the benefits of the automatic stay buying them time to streamline their operations and bounce back by the time the COVID-19 pandemic blows over.

If you’re considering filing, you can chat online with a Laws101.com business bankruptcy attorney where you’ll be instantly connected to a lawyer who can give you legal guidance on your specific case or question.