The COVID-19 coronavirus pandemic has been a wrecking ball to many large and small businesses across the US. Revenues for restaurants and shop owners has dwindled due to a lack of customers. Merchants cannot get their product to market and service providers cannot deliver a service without a physical customer present.

No one could have predicted such an event that would force businesses to shutter, implode the economy and result in the highest unemployment rates in US history, practically overnight.

Experts are hypothesizing that the business interruption losses caused by the novel coronavirus could last years.

Many small businesses are unaware that they may be insured for such losses by their business insurance policy.

So, if you’re a small business owner, have a business insurance policy and suffered business losses due to the coronavirus shutdown, then here’s what you need to know about filing a business interruption claim with your insurance company.

What is Business Interruption Insurance

Many small businesses have a Business Interruption Insurance clause embedded somewhere within their lengthy commercial insurance policy.

Business interruption insurance is intended to supplement lost income and cover expenses when a business is affected by a covered set of circumstances.

So, if you have a business insurance policy, it’s likely you have business interruption insurance and your insurance company is contractually obligated to pay actual business losses if you sustained an interruption of business.

What’s Covered?

The exact amounts vary from insurer to insurer but they all generally cover the following:

- Lost profits

- Lease payments

- Loan payments

- Taxes

- Relocation costs

- Other unexpected business-related expenses that are incurred as a result of the business shutdown

How Do I File a Business Interruption Claim

Just like a loss claim with any other insurance policy, you should call your business insurance agent and file a claim for business interruption. Before you do that, make sure that you dust off your policy and re-read your policy terms for coverage.

If your insurance company processes your claim: great – you got lucky.

Unfortunately, in most cases regarding business losses from COVID-19, insurance companies are denying claims.

Much of the legal community believes that these denials are being made in bad faith for the overriding purpose of profitability for the insurance company.

On the other hand, insurance company lawyers are taking a very different stance on the matter. After all, with the hundreds upon hundreds of billions of dollars of business interruption loss suffered during this pandemic, paying out one claim could very well bankrupt an entire insurance company.

So if you’ve been faithfully paying your business insurance policy and your business interruption claim is denied, what do you do?

What to Do if Your Business Interruption Claim is Denied

The only recourse you have as a policyholder if you feel wrongfully denied in an insurance claim is to file a lawsuit against your insurance company.

In many cases concerning widespread losses, insurance companies make a financial bet that their payout in the form of lawsuits would be less than if they honored their claims. The insurance company knows that if it paid all incoming claims that their losses would be guaranteed to be high. Instead, by requiring their clients to sue them, the individual payouts to a policyholder may be higher, but there would be far fewer payouts, resulting in a higher net profitability.

While a lawsuit may seem daunting, a reputable, experienced lawyer will represent you on a contingency-fee basis, meaning, there are no upfront costs to you and the attorney only gets paid if you win your suit.

That said, lawsuits are time-consuming. Insurance companies know this and will try to draw out the case as long as possible to simply wear you out.

But if there’s any foreshadowing of what’s to come, President Trump contributed to this heated debate during one of his daily coronavirus task force briefings, stating:

“…you have people that have never asked for business interruption insurance, and they’ve been paying a lot of money for a lot of years for the privilege of having it. And then when they finally need it, the insurance company says, ‘We’re not going to give it’ … We can’t let that happen.”

-President Donald Trump (April 10, 2020)

Recent COVID-19 Claim Denials

On March 31, 2020, Texas Governor Greg Abbott issued an executive order prohibiting a person from accessing non-essential services, which was punishable by a fine not to exceed $1,000 or confinement in jail for a term not to exceed 180 days.

As a result of this order, many small businesses suffered huge, unexpected and unpreventable losses.

Following the government shutdown, one Texas brick-and-mortar clothing boutique owner suffered significant financial losses due to a lack of customers who were no longer able to shop at her boutique as a result of the order.

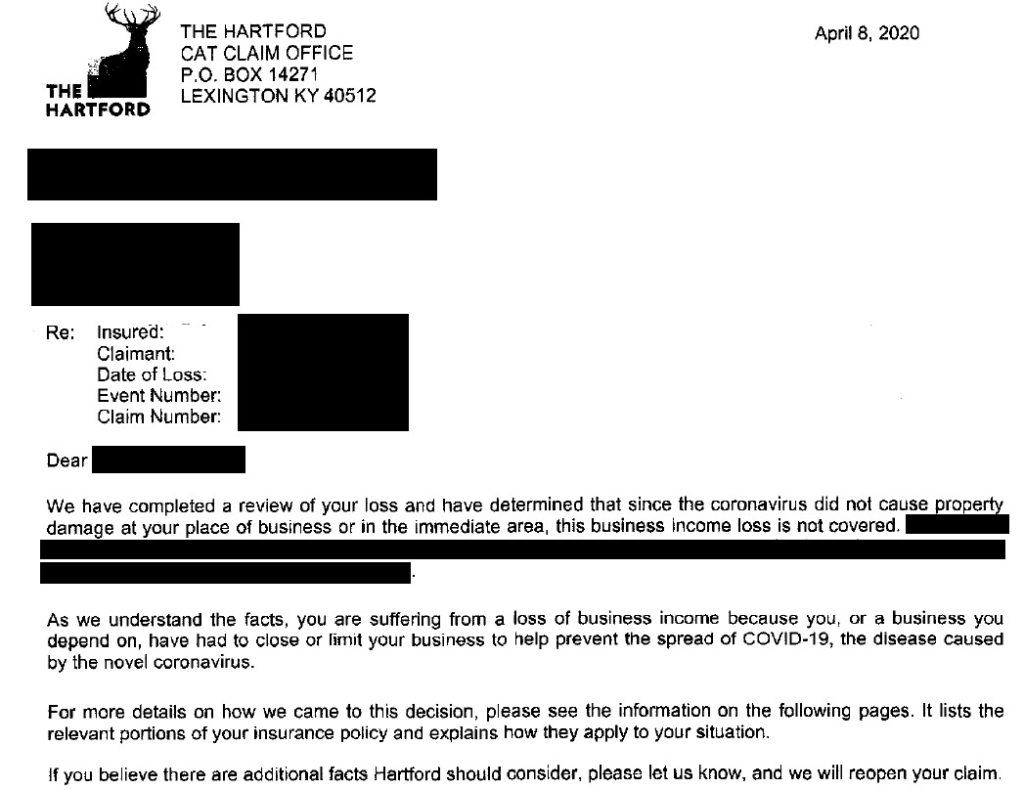

She promptly filed a business interruption loss claim with her insurer, The Hartford Insurance Company, seeking to recover the benefits for which her premiums paid.

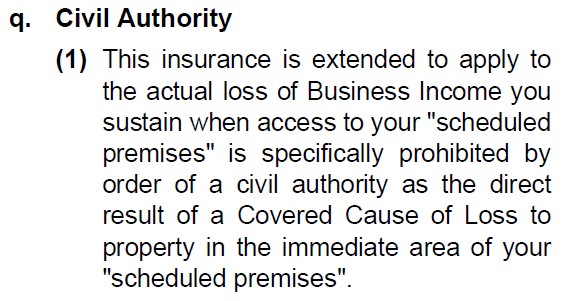

In her insurance policy, there is a specific clause that covers losses resulting from the order of a civil authority, specifically which states:

“This insurance is intended to apply to the actual loss of Business Income you sustain when access to your ‘scheduled premises’ is specifically prohibited by order of a civil authority as a the direct result of a Covered Cause of Loss to property in the immediate area of your ‘scheduled premises’.”

The Hartford Insurance Company denied her claim.

Bad Faith – Coronavirus Lawsuits

This particular policyholder decided to sue her insurance company claiming, among other things, that The Hartford acted in bad faith when denying her claim.

Her attorney, Andrew Cobos of the Cobos Law Firm in Houston, TX says that many others like her are having to do the same with their insurance companies.

Cobos states, “Despite the fact that pandemics aren’t specifically mentioned as an exclusionary event, Hartford sent a vague denial letter to my client and ignores the sections of their contract which provide for exactly this type of circumstance.”

Cobos continues, “Insurance companies confuse their insureds by using confusing or ambiguous language in lengthy contracts. But the language in an insurance policy is no mistake—it is intentional; after all, such ambiguities allow the insurance company to deny claims more easily.”

Unfortunately, litigation is often the only way to hold insurance companies accountable. And although the litigation will take time, the potential exists for her and other claimants to recover up to three times the covered damages and their attorney’s fees.

Getting Help

If you’re a business owner in this situation, you may consider filing a bad faith lawsuit against your insurance company.

But be warned: the insurance companies are prepared to fight these coronavirus business interruption claims and make the process as drawn out and difficult as possible.

Here are some good resources to take advantage of if you’re a business owner and need help with your business interruption claim:

- The Cobos Law Firm – Not only is this firm experienced with bad faith insurance claims, but they are handling COVID-19 claim denial cases. Additionally, they’ve made the process very clear, quick and simple for business owners to file a lawsuit completely online.

- Practical Law White Paper – A recent legal white paper that discusses construction contracts & potential claims under business interruption, civil authority, and other insurance policies in the wake of COVID-19.

- Valuing Business Interruption Insurance Losses – This 2014 Penn State Law eLibrary journal article discusses the complexities of valuing business interruption insurance losses after a catastrophic event.

If you need additional assistance, you can also chat now with a Laws101.com attorney, where you’ll be instantly connected to a lawyer who can give you legal guidance on your specific case or question.