Tax season is a difficult season for some businesses and individuals. This can be because it’s the first year that you’ve had to file difficult taxes (i.e., trusts) or because you’ve let tax payments add up – no matter what the situation is, there is help.

Two of the most common options are a tax attorney or a Certified Public Accountant (CPA). Knowing which professional is best for you depends on your unique goals and needs, as well as your tax status with the Internal Revenue Service (IRS).

Tax debt isn’t a small matter, so hiring the right professional for your tax needs is essential to make sure that you don’t fall behind with tax payments and filing.

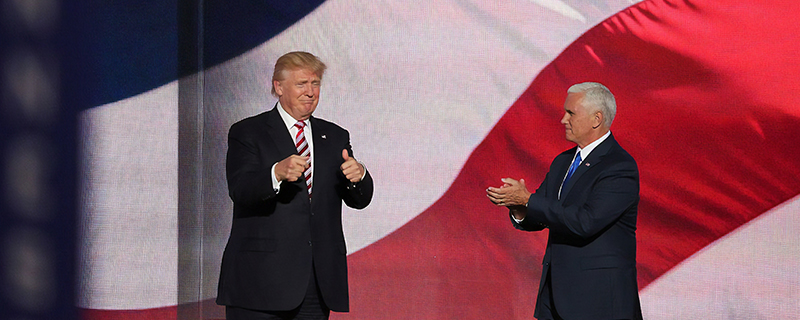

Trump Tax Plan & How it Affects Your Taxes

December 22, 2017, President Trump signed the Tax Cuts and Jobs Act. This act cuts individual income tax rates, eliminates personal exemptions, and doubles the standard deduction.

The 2019 tax brackets have changed a lot since this act went into action. For instance, if you were in the 33- to 35-percent tax bracket in 2017, you’re now being taxed at 35 percent. Other tax brackets were changed, but we won’t get into that.

As a result, more people are being subjected to the highest federal tax bracket than they would have under the old method. By 2025, 8.9 percent of taxpayers will be paying more than they would’ve if the Trump tax plan hadn’t happened.

With all of these changes, it makes sense that you would be considering hiring a tax attorney or CPA to help you figure out the new tax laws and rules. However, how do you know which one is best for your situation and needs? In the next section, we’ll go over what each professional does and when you might need to hire them.

Tax Attorney

Tax attorneys understand the IRS tax code inside and out. They can provide guidance and advice on complex legal issues, especially in the area of business tax law, estate planning, trusts, and tax disputes. Tax attorneys are great negotiators who can analyze case facts in terms of the law and build arguments around the desired outcome.

There are a few tax attorneys who can even help prepare tax returns for a fee; however, they aren’t accountants and aren’t involved in filing taxes for the IRS very often. Tax attorneys don’t hold the same knowledge of an accountant when it comes down to maximizing your deductions and planning for the future.

There are several reasons why you might need a tax attorney, including:

- You’re starting a business and require legal counsel to figure out the tax treatment and structure of your company

- You’re working internationally in business, and you require help with the tax treatment, contracts, and other legal matters

- You want to bring a lawsuit against the IRS

- You’re under criminal investigation by the IRS

- You need the protection of attorney-client privilege because you committed a tax crime

Certified Public Accountants (CPA)

CPAs are educated in maintaining financial and business records. They are also able to help prepare your tax returns, ensure that you follow the tax code, and correct or file your tax returns. They are also able to represent you in front of the IRS. CPAs can provide financial planning and are a great resource for those seeking comprehensive tax plan to help with professional and personal financial issues.

CPAs know how to abide by federal tax laws while maximizing your tax benefits and minimizing your tax liability. Typically, you want to hire a CPA if you have much money coming in and out because you can benefit more during the tax season.

There are several reasons why you might need a CPA, including:

- You have complicated tax situations (i.e., you own a business)

- You want to develop a long-term relationship with a tax professional

- You want help figuring out a long-term tax plan

- You are seeking monthly and annual accounting services

- You want someone who has training specifically for taxes to do your returns

Do I Need a Tax Attorney or CPA?

Are you still unsure if you should work withtax attorneys or a CPA? If so, consider your tax situation.

Are you having to wade through complex business or personal taxes and want to find a way to minimize your tax liability? If so, then you should hire a CPA.

Are you in trouble with the IRS, dealing with a tax controversy matter, or receiving debt collection notices? If so, then you should hire a tax attorney.

If you need a tax attorney, don’t hire a CPA in their place – you’ll only end up in more trouble with the IRS, and could ultimately cost you more than what a tax attorney would originally cost you.

Another area that tax attorneys are helpful in is tax planning because they can minimize your tax liability over the years by structuring your assets.

However, if you only require help with tax preparation and aren’t in any trouble with the IRS, you should consider hiring a CPA instead.

Intervention vs. Prevention

Both tax attorneys and CPAs can help you with financial decisions, lowering tax penalties, and tax planning. CPAs have more experience on the financials of tax prep, but attorneys can give legal advice if you are facing adversity or other issues.

If you are searching for someone to represent you in a tax defense case, you should go with an attorney. They are also able to help you work through cases involving major tax debts or other complex issues. This is because attorneys have gone through more training in dispute resolution than a CPA.

If you still aren’t sure if you should hire a CPA or a tax attorney, you can easily contact one of these professionals in your area to find out more information about what they could do for you.