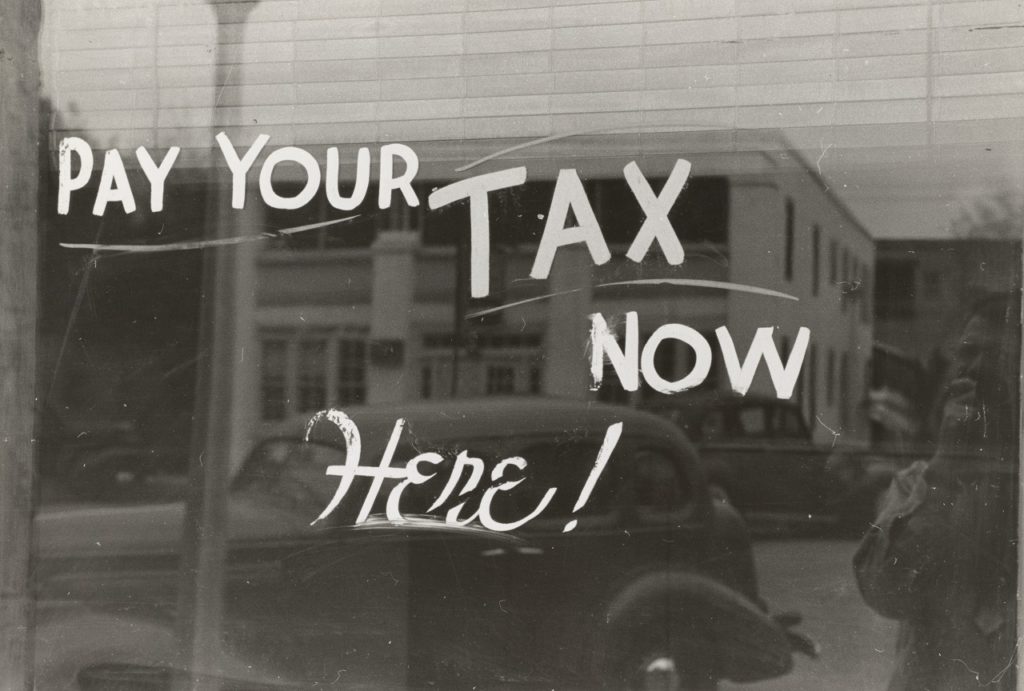

Money is a major pain point for most people, but you know what’s even more stressful? – Having to deal with the IRS.

Tax season is right around the corner, and for most people, it means having to comb through mountains of paperwork and file your returns like an upstanding tax-paying member of the society. But did you know that you could potentially be losing money if you don’t let a professional help you with the process?

And, what about that notice from the IRS that showed up in the mailbox informing you that you have accrued interest on unpaid balances? This is all news to you. As far as you know, you’ve been diligently paying all your taxes, so the notice you’ve received just doesn’t add up.

That would be the perfect time to get in touch with an IRS tax lawyer to help you make sense of everything and get your affairs in order. Here’s everything you need to know about when to hire an IRS lawyer.

When You Need to Hire an IRS Tax Lawyer

You’re probably wondering why you would need a tax attorney and not a certified public accountant to handle your tax issues. While both professionals offer invaluable help to taxpayers, their roles are completely different.

If you have a complicated tax-filing situation on your hands, then you want to bring an accountant on board. Complex tax situations could involve anything from having a business (or two) that has a lot of money coming in and out, having kids, being divorced, etc.

They know how to minimize your tax liability without undermining federal law. You would typically call on an accountant to handle your financials when you need a little help with the filing process.

A tax attorney, on the other hand, is the person you call when your tax issues take a legal turn – usually for the worst. You call them when you need help dealing with legal tax matters such as halting wage garnishment, canceling account levies and property liens, getting help with unfiled returns, and even coming up with a legally binding compromise with the IRS on matters related to your tax debt.

When you’re in some kind of trouble with the IRS or have any sticky issue that’s outside the scope of crunching numbers, then you call on a tax attorney, not an accountant.

The type of tax attorney you choose depends on the specific kind of tax help you need. For instance, if your tax issues have to do with estates and trusts, then you need a tax lawyer whose specialty lies in these areas.

How to Dispute the IRS

Having to deal with the IRS can be the most daunting and frustrating experience, especially if they claim that you owe them money. It can be a nightmare!

The good news is that you can dispute IRS tax debt when they allege that you owe hundreds or even thousands of dollars in back taxes. Here’s how to go about it.

1. Read the Tax Collection Notices Sent by the IRS

Pay close attention to the type of notice you receive. The CP notice number indicated on the top/bottom right corner identifies the type of notice you have on your hands. For instance:

- CP-14 is a notice typically received four to six weeks after filing your return, to inform you that you owe taxes

- CP-504 is the final warning notice of unpaid tax balances

- CP-1058 is a Notice of Intent to Levy. It lets you know that the IRS intends to put a tax levy on or garnish your wages to recover what you owe in back taxes

2. Contact the IRS Immediately

Once you receive any notice from the IRS, get in touch with them as soon as you can to let them know that:

- You dispute the tax debt that you allegedly owe

- You are not waiving your right to a tax hearing or settlement

- You’ll be in touch with a tax professional to help with the IRS dispute

It’s important to let a tax lawyer handle the IRS dispute resolution process for you. Attempting to do it on your own might not yield the outcome you expect.

It’s also important to read and understand the Taxpayer Bill of Rights to familiarize yourself with what you are entitled to, to make sure that you’re treated fairly during the process.

3. Request an Appeal

The next step of the IRS dispute process is to make a written request to the IRS Office of Appeals. Some important information you need to include is:

- Your contact details

- The tax period you are disputing

- The reasons for the dispute

- Facts and evidence to back up your reasons

- Quote the law or authority that supports your reasons

Mail the letter to the address listed on the “Rights to Appeals” section in the letter that came with the IRS correspondence.

4. Get the Best IRS Tax Attorney to Represent You

Legal tax matters are often complex to deal with, particularly if you don’t have a background in tax law. Getting unlimited representation is the best strategy since it gives your lawyer the right to represent you in any way they see fit when resolving your tax issues. They are highly qualified and experienced to deal with any IRS dispute you have to get the best possible outcome.

5. IRS Tax Dispute Resolution

The final step in the tax resolution process is the actual resolution. While it is possible to get an outcome that results in zero payments, more often than not, you may have to pay a much smaller amount on the balance you owe. Some of the payment options available include:

- Applying for an Offer In Compromise

- Applying for monthly installment payments

- Settling as much of the debt as you possibly can

These options are available to you based on your ability to pay. Your attorney will be able to negotiate a tax debt relief program that works for you.

Get the Best IRS Tax Lawyer in Your Corner

Knowledge is crucial when it comes to IRS tax dispute resolutions. So, going it alone is not an option if you want to get the best possible outcome from the process. Get the best IRS tax lawyer to represent your interests and resolve your tax issues once and for all.

If you have more legal questions, you can also chat now with a Laws101.com attorney, where you’ll be instantly connected to a lawyer who can give you legal guidance on your specific case or question.